In order to expand investment activity, improve the business environment, and increase industrial production, the investment promotion mechanism was established and improved by Decree No. 745 of the President of the Republic of Azerbaijan dated January 18, 2016 "On Additional Measures Related to Investment Promotion", the "Rules for Issuing a Confirmation Document for the Import of Machinery, Technological Equipment and Devices to Legal Entities and Individual Entrepreneurs Who Have Received an Investment Promotion Document" approved by Decree No. 877 dated April 20, 2016, and Decree No. 1913 dated December 20, 2022 on Improving the Investment Promotion Mechanism, and favorable conditions have been created for legal entities and individual entrepreneurs engaged in entrepreneurial activity in accordance with the relevant criteria to obtain tax and customs benefits.

According to the latest changes to the investment promotion mechanism, an investment promotion document is issued for 3 years from January 1, 2023 to projects to be implemented in industrial districts, agroparks, tourism and recreation zones, relevant territories (except for the cities of Baku, Sumgayit, Ganja, Absheron region and other cities and regions, liberated from occupation), as well as strategic projects to be implemented in the directions determined by the head of state. The criteria established in the new mechanism include the field of recycling of environmentally important waste and the expansion of tourism-oriented areas of activity. The new mechanism is mainly aimed at the development of regions and increasing investment potential. An investment promotion document is a document that provides the basis for obtaining the benefits specified in the Tax Code of the Republic of Azerbaijan and the Law of the Republic of Azerbaijan "On Customs Tariff" for 7 years from the date of receipt of the document. These benefits include:

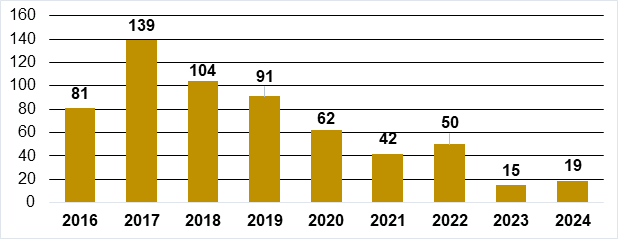

In total, 605 investment promotion documents were submitted to 501 business entities by 01.05.2025. As a result of the implementation of the projects for which the investment promotion document was submitted, it is expected that more than 7.3 billion manats will be invested in local production and more than 43.4 thousand jobs will be created. 13% of the promoted projects fall on the city of Baku and surrounding settlements, and 87% on the regions. 62.5% of the submitted investment promotion documents cover projects to be implemented in the fields of industry, 34.0% on agriculture, 1.8% on logistics, and 1.7% on tourism.

In particular, 19 investment promotion documents were submitted to 19 business entities during 2024. As a result of the implementation of projects for which investment promotion documents were submitted, it is expected that 1.6 billion manat will be invested in local production and 4,432 new jobs will be created.

Distribution of issued ITS by year

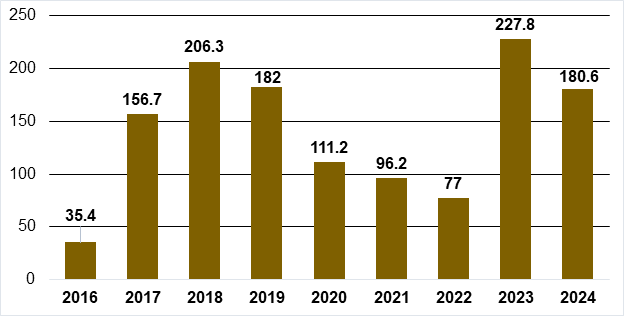

By 01.01.2025, 6,139 approval documents were issued for the import of machinery, technological equipment and facilities worth 1.3 billion US dollars, and entrepreneurs received relief in the amount of 310.6 million US dollars from taxes and duties applied to imports.

Value of equipment imported at a discount (million US dollars)

In total, for 327 projects (54%) that have been granted investment promotion documents, the value of equipment imported with supporting documents (invested amount) has exceeded the minimum investment amount envisaged for those projects.

By May 1 of this year, 2 investment promotion documents were submitted to 2 business entities. As a result of the implementation of the project for which the investment promotion document was submitted, it is expected that about 1.5 million manats of investment will be invested in local production and 34 jobs will be opened. At the same time, during the mentioned period, 113 confirmation documents were issued to legal entities and individual entrepreneurs who received investment promotion documents for the import of machinery, technological equipment and devices worth 67.5 million US dollars, and entrepreneurs were exempted from taxes and duties applied to imports (received a discount of 16.2 million US dollars).

Sample Application to obtain an Investment Promotion Document Sample Application to obtain a supporting document Guidelines