- Inward processing is a special customs procedure consisting of importing certain goods to the customs territory of the Republic of Azerbaijan without customs duties and taxes, including VAT, for the purpose of export after processing operations.

- Processing operations mean preparation, processing, reprocessing and repair of goods.

- "Rules for placement of goods under the special customs procedure for inward processing" approved by Resolution of the Cabinet of Ministers of the Republic of Azerbaijan of January 14, 2014, No. 4 were amended and simplified by Resolution No. 102 dated April 10, 2023.

- As a result of the main innovation caused by the changes to the rules, the owner of the procedure gets the opportunity to import raw materials or materials from any country to the country and process them within the time frame stipulated by the legislation and export them to any buyer in any country based on the purchase agreement as well as the purchase order.

- Another important innovation provided by previous changes to the rules is the removal of mandatory security for the payment of customs duty.

- In addition, as a result of recent changes, the documentation process for obtaining a permit to use the special customs procedure for inland processing has been simplified too.

- Until the changes to the rules were adopted, the possibility of using the inward processing special customs procedure was limited to a type of purchase order (processing) and there was a mandatory security requirement.

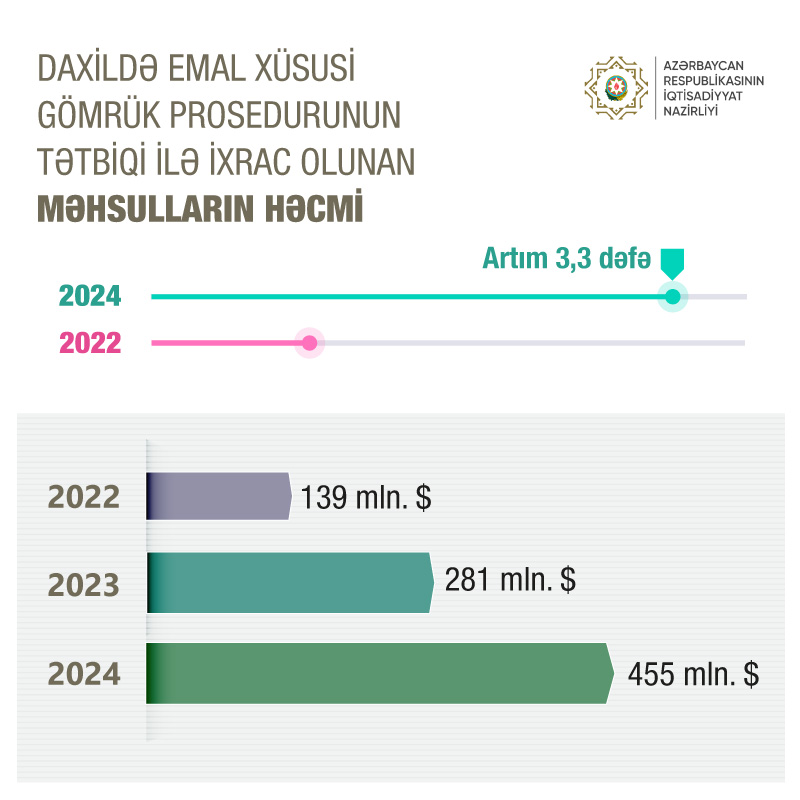

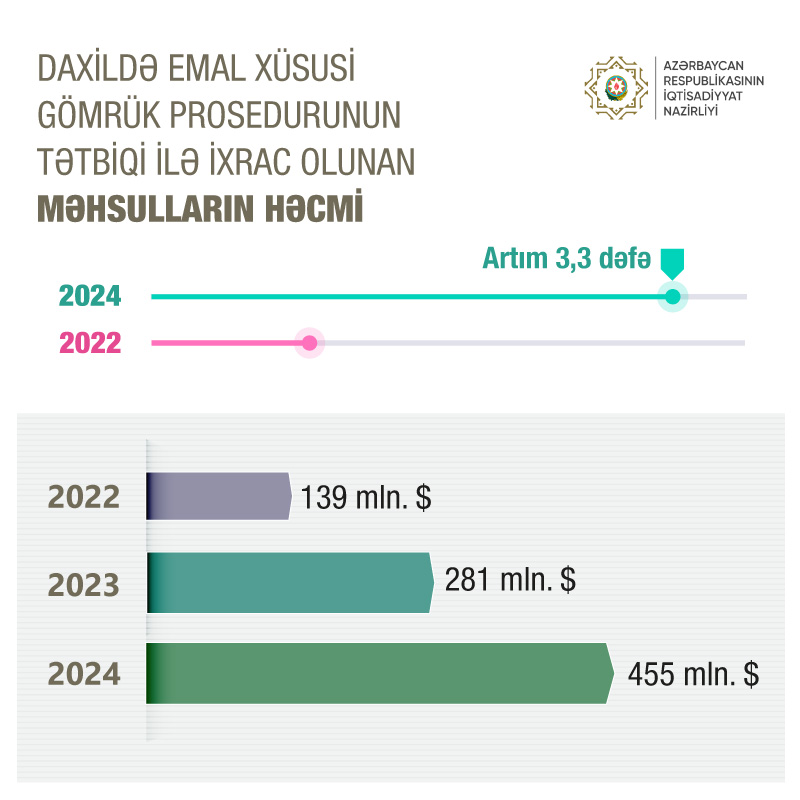

As a result of the application of the special customs procedure of inward processing, the volume of goods exported using the procedure increased by 3.3 times in 2024 compared to 2022, amounting to 455 million US dollars.

Learn more

Entrepreneurs can apply to the State Customs Committee directly or through relevant local authorities.